Feature Article

04/28/11 Categories: Feature Article

Highlights: Harrison’s Complete UAD Guide

by Henry S Harrison

As of September 1st, 2011, appraisers will be required to make some significant changes in the way they prepare the URAR because Fannie Mae, Freddie Mac, FHA, and the VA are going to require all appraisal reports be transmitted electronically in a standardized format. All URAR appraisal reports with an effective date on or after the first of September submitted to Fannie Mae or Freddie Mac will have to meet the new Uniform Appraisal Dataset (UAD) standards (and shortly for FHA and VA too).

The UAD requirements have been designed to allow appraisers to make appraisals that comply with the USPAP, and include everything the appraiser believes is necessary to make a credible appraisal as required by the USPAP. Appraisers should start making appraisals that meet UAD standards as soon as possible. To meet these highly specific requirements, they will need a form-fill input program sold by an approved software vendor. The software dealers in the appraisal industry are gearing up to make their program output coincide with the UAD requirements, and have it available soon so that appraisers have sufficient time to learn how to use the new UAD format.

The UAD is highly specific about the style, format and presentation of all data entered on the URAR. The biggest change, in my opinion, is that appraisers will no longer be able to use qualifiers such as “poor”, “fair”, “good” or “very good” in their property quality and condition ratings. Under UAD, only six quality ratings are feasible: Q1, Q2, Q3, Q4, Q5 or Q6. Similarly, six precise condition ratings are provided: C1, C2, C3, C4, C5 or C6. Each of these ratings is defined by the UAD guidelines, and appraisers are not permitted to modify them with plus “+” or minus “-” signs, or any other modifier.

by Henry S Harrison

As of September 1st, 2011, appraisers will be required to make some significant changes in the way they prepare the URAR because Fannie Mae, Freddie Mac, FHA, and the VA are going to require all appraisal reports be transmitted electronically in a standardized format. All URAR appraisal reports with an effective date on or after the first of September submitted to Fannie Mae or Freddie Mac will have to meet the new Uniform Appraisal Dataset (UAD) standards (and shortly for FHA and VA too).

The UAD requirements have been designed to allow appraisers to make appraisals that comply with the USPAP, and include everything the appraiser believes is necessary to make a credible appraisal as required by the USPAP. Appraisers should start making appraisals that meet UAD standards as soon as possible. To meet these highly specific requirements, they will need a form-fill input program sold by an approved software vendor. The software dealers in the appraisal industry are gearing up to make their program output coincide with the UAD requirements, and have it available soon so that appraisers have sufficient time to learn how to use the new UAD format.

The UAD is highly specific about the style, format and presentation of all data entered on the URAR. The biggest change, in my opinion, is that appraisers will no longer be able to use qualifiers such as “poor”, “fair”, “good” or “very good” in their property quality and condition ratings. Under UAD, only six quality ratings are feasible: Q1, Q2, Q3, Q4, Q5 or Q6. Similarly, six precise condition ratings are provided: C1, C2, C3, C4, C5 or C6. Each of these ratings is defined by the UAD guidelines, and appraisers are not permitted to modify them with plus “+” or minus “-” signs, or any other modifier.

There are three additional UAD required overall property ratings: “Not Updated”, “Updated”, and “Remodeled”, which are the only permitted choices. Each has a precise UAD definition that cannot be modified. However, appraisers can still add their explanatory comments on an available comment line or in the addenda to the report. The software captures and transmits additional data as long as it meets the UAD input requirements. Anything the appraiser thinks is needed to fully explain their rating choices can be added in the Additional Comments section, can be transmitted by the computer, and will be available to anyone who reads the report.

The lines and checkboxes are divided into these classifications:

•UAD Required: This data is required for all appraisals.

•UAD Conditionally Required: This data is required when it is available and applicable.

•UAD Instruction: This is an instruction that explains more about how to handle the data.

The software must capture and transmit all of these classifications of data, which can be reported in one of six types of fields.

• String - Any characters or punctuation are permitted,

but the maximum length of the field may not be exceeded.

• Enumerated - Only specific characters and punctuation are permitted.

• Time/Date - Precise formats are specified for the time and/or date.

• Numeric - Only numbers may be entered, without any punctuation.

• Money - Only dollar values may be entered in a prescribed manner.

• Boolean - The only answers are yes or no, but their representations vary.

Therefore, each Boolean field has specific instructions.

My new UAD book provides instructions for each line or checkbox on the URAR that contains a UAD number, which is almost every line and all the checkboxes on the form.

There are about 225 numbered lines and checkboxes just on the first page of the URAR alone. There are 51 required abbreviations that must be used on specific lines where the character limit is not sufficient in length to spell out the words. These abbreviations are provided in the addenda to this book. The book does not duplicate the line-by-line instructions and hundreds of pages of my companion book, Harrison’s Illustrated Guide: How to Fill Out the URAR Single Family Appraisal Report Form (Fannie Mae 1004-Freddie Mac 70).

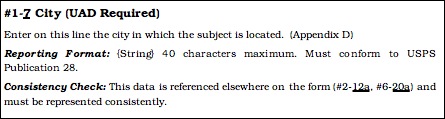

The following is an example of the UAD instructions provided in the book for one line on the URAR:

The first line starts with ‘#1’, which indicates that the instruction applies to an item on page 1 of the URAR. The ‘-7’ indicates the UAD number. When it is underlined, it refers to a numbered line. (If it were shown as ‘-[7]’, it would indicate the UAD number was inside a checkbox.) Some of the UAD numbers on the URAR are preceded by an ‘e’. This is important to the computer programmers but not for appraisers. Next is the URAR item description, in this example ‘City’. The words at the end of the line, ‘(UAD Required)’, indicate that this line must be completed for all appraisals. Alternatively, it could say ‘(UAD Required Conditionally)’, which means it would be required only when there is information available to complete it. When there is nothing at the end of the first line of an item, it means filling out the line is optional as far as the UAD is concerned. However, these lines should be used to comply with the USPAP requirement to make a credible appraisal.

The second line is a description of what must be entered on the line.

The third line is the Reporting Format. It provides precise instructions on how to fill out the line or checkbox. It starts with the type of line or checkbox shown between brackets: {String}. Next is the maximum number of characters the field will hold. If you exceed this number, the computer will chop off the excess information and it will not go into the system. Sometimes there are additional instructions, as in this example, which points out that all addresses must comply with the USPS Publication 28 instructions. The book provides a two-page abridgement of the Post Office’s long and complicated publication that should suffice in most cases. At times it may be necessary to consult the local postmaster for addressing instructions that pertain to the specific locale of the subject property.

The last line is the Consistency Check. Some software programs will do this automatically. If yours doesn’t, you have to be very careful to follow these instructions, as any inconsistency will probably cause the Fannie Mae/Freddie Mac/VA/FHA computers to reject your appraisal.

The example above is for a fairly typical line. Some lines and checkboxes are more complex, and have special requirements. Hopefully, these initial highlights and instructions will help you understand my purpose in writing Harrison’s Complete UAD Guide for the URAR. If you wish to purchase a copy of the book, or buy the combo package (the UAD Guide and my Illustrated line-by-line guide to the URAR) Click here: www.formsandworms.com

HSH

The lines and checkboxes are divided into these classifications:

•UAD Required: This data is required for all appraisals.

•UAD Conditionally Required: This data is required when it is available and applicable.

•UAD Instruction: This is an instruction that explains more about how to handle the data.

The software must capture and transmit all of these classifications of data, which can be reported in one of six types of fields.

• String - Any characters or punctuation are permitted,

but the maximum length of the field may not be exceeded.

• Enumerated - Only specific characters and punctuation are permitted.

• Time/Date - Precise formats are specified for the time and/or date.

• Numeric - Only numbers may be entered, without any punctuation.

• Money - Only dollar values may be entered in a prescribed manner.

• Boolean - The only answers are yes or no, but their representations vary.

Therefore, each Boolean field has specific instructions.

My new UAD book provides instructions for each line or checkbox on the URAR that contains a UAD number, which is almost every line and all the checkboxes on the form.

There are about 225 numbered lines and checkboxes just on the first page of the URAR alone. There are 51 required abbreviations that must be used on specific lines where the character limit is not sufficient in length to spell out the words. These abbreviations are provided in the addenda to this book. The book does not duplicate the line-by-line instructions and hundreds of pages of my companion book, Harrison’s Illustrated Guide: How to Fill Out the URAR Single Family Appraisal Report Form (Fannie Mae 1004-Freddie Mac 70).

The following is an example of the UAD instructions provided in the book for one line on the URAR:

The first line starts with ‘#1’, which indicates that the instruction applies to an item on page 1 of the URAR. The ‘-7’ indicates the UAD number. When it is underlined, it refers to a numbered line. (If it were shown as ‘-[7]’, it would indicate the UAD number was inside a checkbox.) Some of the UAD numbers on the URAR are preceded by an ‘e’. This is important to the computer programmers but not for appraisers. Next is the URAR item description, in this example ‘City’. The words at the end of the line, ‘(UAD Required)’, indicate that this line must be completed for all appraisals. Alternatively, it could say ‘(UAD Required Conditionally)’, which means it would be required only when there is information available to complete it. When there is nothing at the end of the first line of an item, it means filling out the line is optional as far as the UAD is concerned. However, these lines should be used to comply with the USPAP requirement to make a credible appraisal.

The second line is a description of what must be entered on the line.

The third line is the Reporting Format. It provides precise instructions on how to fill out the line or checkbox. It starts with the type of line or checkbox shown between brackets: {String}. Next is the maximum number of characters the field will hold. If you exceed this number, the computer will chop off the excess information and it will not go into the system. Sometimes there are additional instructions, as in this example, which points out that all addresses must comply with the USPS Publication 28 instructions. The book provides a two-page abridgement of the Post Office’s long and complicated publication that should suffice in most cases. At times it may be necessary to consult the local postmaster for addressing instructions that pertain to the specific locale of the subject property.

The last line is the Consistency Check. Some software programs will do this automatically. If yours doesn’t, you have to be very careful to follow these instructions, as any inconsistency will probably cause the Fannie Mae/Freddie Mac/VA/FHA computers to reject your appraisal.

The example above is for a fairly typical line. Some lines and checkboxes are more complex, and have special requirements. Hopefully, these initial highlights and instructions will help you understand my purpose in writing Harrison’s Complete UAD Guide for the URAR. If you wish to purchase a copy of the book, or buy the combo package (the UAD Guide and my Illustrated line-by-line guide to the URAR) Click here: www.formsandworms.com

HSH