Ask Henry

Good Afternoon Henry,

I am at a loss. I've been asked to do an exterior appraisal of two duplexes. My client has a second mortgage on the two properties and needs to know the value of each property. No rental information is required. Public data is rather sketchy. My problem is that my software provider has no form for such an assignment. Would it be possible to use the FNMA 2055? Or, how would you suggest I proceed? Thank you in advance for your help.

Best regards,

Bob (Bear) Klingensmith

Georgia Certified Residential Appraiser

bobklingensmith21@gmail.com

Dear Bob,

Since this appraisal is not going to Fannie Mae or Freddie Mac you can use any form you and your client agree upon. You can use the 2055 but you must be careful to correctly modify it. In this type of situation, the form is really just a cover sheet and you should plan to use an addenda to present any information you need to explain what assumptions you will be making. These will have to be extensive as you will not inspect the interior of either property nor do you have any rental or expense information. Keep in mind that it is up to you to feel comfortable that you are making a "credible appraisal' as required by the USPAP. Many appraisers would not be confident that they could make a credible appraisal under these conditions.

Ask Henry

Dear Henry,

Would you include the GLA of an indoor heated pool within the GLA area if the pool is located on the lower walkout basement area?

Thank you.

Norma Nicholson

norma@nicholsonappraisalservice.com

Dear Norma,

The Fannie Mae GLA specifications are only guidelines and can be adjusted to reflect what is most common in your market area.

One GLA guideline is that only areas of the dwelling that are 100% above ground and heated and finished like the main part of the house should be included. I doubt the drafters of the original guidelines were thinking about indoor heated pools.

The important thing to remember is that whatever you do, you need to explain in detail in the appraisal so that the users of the appraisal and reviewers who has access to some other source of the property GLA measurement will not confused by the difference. This will also help explain the basis of any adjustments to the comparable sales based on the difference in GLA.

Ask Henry

Dear Mr. Harrison,

If contract revisions occur after the date of the appraisal and the lender has furnished a new contract, should these modifications be made to the contract portion of the appraisal to reflect a change in seller contribution, etc.? Or must the appraisal be entirely based on information obtained as of or before the effective date of the appraisal?

Best Regards,

Todd Floyd

toddfloyd@bellsouth.net

Dear Todd,

The requirement is that the lender supply you with their latest ratified version of the sales contract. This usually has no impact on your estimate of the market value in the appraisal. As part of your scope of work dialogue with the lender, you should agree on the effective date of the appraisal. There is no Fannie Mae or Freddie Mac regulation that I am aware of that prevents you from using information about things that happen after the effective date of the appraisal. However, when you incorporate this information, you should carefully explain in the appraisal what you have done so that there is no room for confusion or misinterpretation.

Ask Henry

Dear Henry,

I work at a community bank and am new to appraisal review. We are getting very unclear information from our examiners as to what we need for a residential appraisal. Up until recently, they accepted a BPO (Broker Price Opinion) for a routine (yearly) value update on loans under $500,000. Now a different examiner states that BPOs are not acceptable, and requires that we get a full appraisal for everything with a mortgage balance over $250,000.

One examiner told us that all residential appraisals must be made according to USPAP. In trying to reduce our ridiculous costs in having to order a brand new appraisal for every residential annual value update, a few appraisers have submitted their reports on Form 2055 (basic drive-by). This form cannot meet USPAP in its brevity. Do you know if the OCC will accept a Form 2055 for a residential valuation update? And do you have any recommended websites where I can search for additional information on the uses of the various residential appraisal forms?

Thank you in advance for your help,

Mary F Miron

mmiron@fbfna.com

Dear Mary,

There is nothing in the USPAP that specifies what type of appraisal report the appraiser must use. Therefore, this is something your institution must determine based on their needs and requirements. They must comply with all their regulators' requirements. I sympathize with their dilemma. As far as your statement that an appraisal report on the Form 2055 "cannot meet USPAP requirements in its brevity", that's just not the case. An appraisal reported on the 2055 still must meet all USPAP requirements. The choice of the form does not dictate the comprehensiveness of the appraisal itself.

Ask Henry

Dear Mr. Harrison,

I'm having problems defining the address for many properties I appraise. Here in New Jersey we have properties (typically within Townships) that utilize both (1.) "census-designated" areas (or districts) within the township or (2.) names of neighboring towns for use in their "Mailing Address".

For example:

125 Main Street, MORGANVILLE, NJ is in Marlboro Township

125 Main Street, BELLE MEAD, NJ could be in either Hillsborough or Montgomery Township

125 Main Street, PRINCETON, NJ could actually be in South Brunswick Township (e.g., a different town and county)

I have always written my reports to identify the actual "CITY", "TOWNSHIP" or "BORO" (as per TAX RECORDS) within the CITY FIELD on the appraisal report.

I have always identified within the ADDRESS FIELD on the appraisal report the "mailing address", which would read as noted above.

Thus:

ADDRESS: 125 Main Street (Princeton) CITY: South Brunswick Township

I always include language (in the notes section) as to where I obtained this data, an explanation about census-designated areas or districts within townships, or comments (as in the example above) that the mailing address may utilize the name of a neighboring town.

If an appraiser were to not identify the actual Township, I feel this could be misleading. Especially in the examples used above with both Belle Mead and Princeton: if an appraiser were to only identify "Belle Mead", what actual TOWNSHIP is it in -- Hillsborough or Montgomery?

If an appraiser were to only identify "Princeton", the reader might actually think the property is in Princeton (Mercer County) and not South Brunswick (Middlesex County). Both answers are therefore misleading and incomplete.

Now, AMCs inform me their lender clients want "Princeton" ONLY in the CITY Field. I cannot agree with that. So here comes the question: What is the proper way to do this, and handle my concerns and dilemma with the AMCs? Thanks in advance for your help.

Randy L. Cohen, SCRREA

DK REAL ESTATE APPRAISAL INC.

dkappraisal@yahoo.com

Dear Randy,

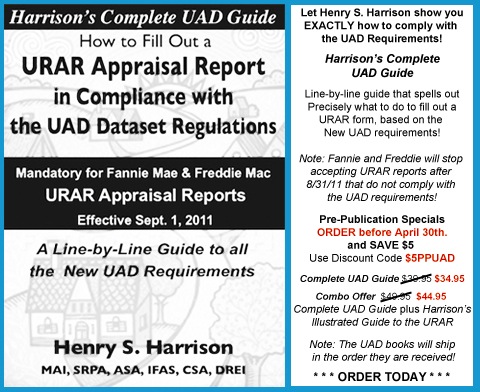

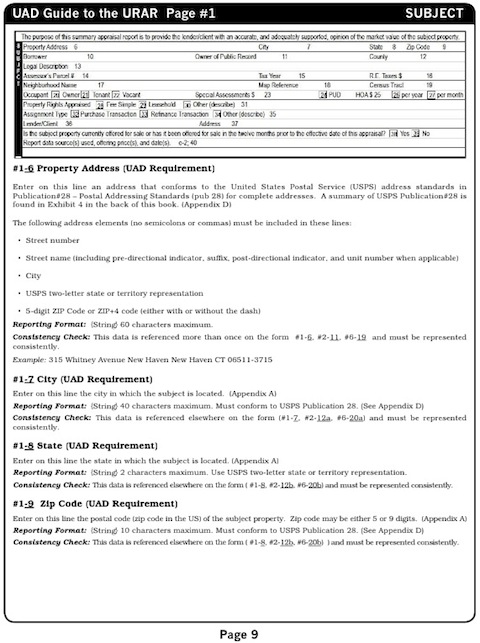

I'm sure it is frustrating to be told to report something that makes no sense, given the complexity of place names in your area. You will no longer have this problem starting September 1st, 2011 when URAR appraisal reports will have to comply with the new UAD requirements. These requirements will become mandatory on that date for all appraisals to be sold to Fannie Mae and Freddie Mac. They will be computer checked and when the computer rejects the appraisal, it will be returned to the lender for corrections. How the corrections will be made and by whom will vary.

Below is an excerpt from my new UAD book, regarding the UAD requirements on how to report Property Address. It is highly codified, as you will see, and does not permit any deviations from their format. You may have to add your notes about the actual property address versus the mailing address in your addenda, to avoid the problems you outline above. The UAD guide contains a condensation of USPS Regulation 28 which is all you need for most locations. However, in locations like yours, I suggest you contact the postmaster in the area where you are working and get their opinion of the correct address requirements for the location of the subject property.

HSH

askhenryharrison@revmag.com

For more information about my new book, to be published April 30th, and to pre-order a copy now (and get a $5 pre-publication discount), use Discount Code $5PPUAD and click this link: HARRISON's COMPLETE UAD BOOK (PRE-ORDER)

Ask Henry

Dear H2,

What type of license is needed to do County Assessor work? If we appraisers wanted to help homeowners reduce their property tax burden, by being consultants for them, do we need a license? E & O Insurance? What would be expected of us?

TJ

Timothy O'Brien

timnd75@verizon.net

Dear Timothy,

The kind of license that is needed to do assessor work depends upon the state in which you are located. You should check with your Real Estate Appraisal Commission or an attorney who can look up the law for you. The same is true for what license is needed to do tax consulting work and if E & O insurance will be required. What would be expected of you is that you have the education and experience to do a "credible" job.

Ask Henry

Dear Mr. Harrison,

I recently did an exterior-only VA Liquidation Appraisal on a dwelling built in 1924. Normally we do a full appraisal on these properties, but the owner would not let me in. The dwelling had some obvious deferred maintenance, but it’s a brick dwelling and I anticipate that it will be around for many years yet. My estimated value was about $100,000. If the dwelling were nicely refurbished, it might command a value of about $150,000 in its neighborhood.

The VA review appraiser told me that since I did not gain entrance to the dwelling, I was required to use the actual age of 87 years as the effective age. (I used 12, which in looking back, I do think was too low.) Most appraisers I talk to seem to follow the old Marshall-Swift mindset of 60 years as the typical total economic life of a property. Would you give me your thoughts?

Gary Moyer

ga.moyer@rcn.com

Dear Gary,

The effective age of a house depends mostly upon its design and condition. I have always believed that "benchmarks" are of little use in appraising, and this is a good example. I doubt the VA review appraiser has anything to back up his or her wrong opinion! If you render an opinion about a property you have not completely inspected you have to make some assumptions about what you did not see. The USPAP requires that you make a "credible" appraisal. In view of the circumstances, I suggest that you put this job behind you and move on.

Ask Henry

Dear H2,

The UAD is scheduled to go into effect September 1st, 2011. What will happen to the UAD requirements if Fannie and Freddie are no longer around in September?

Brent Hodges

sbhodges@bellsouth.net

Dear Brent,

It's anyone's guess how long Fannie and Freddie will "be around". However, I'm a betting man and will accept reasonable wagers that both of these so-called Government Sponsored Enterprises (GSEs) will be around on September 1, 2011. I might even consider a bet on September 1, 2012.

Ask Henry

Dear Henry,

I am going to take advantage of your COMBO offer and order your new Complete UAD Guide and the Illustrated Guide to the URAR form. However...I noticed that the UAD is already being revised. How will you handle that? Will you be emailing updates, blogging about them or what? I realize it is our responsibility to stay up on this; however you might have a great sales tool if you promised to cover all updates on your website or send something by email to us. I have a fear of missing something if it is only up to me to track this monster coming in September! I don't underestimate what a big change this will mean for us appraisers.

Thanks,

Alisa McKeel Willson

CA State Certified Appraiser

appraiseralisa@gmail.com

Dear Alisa,

You are quite right in assuming that there will be corrections and updates to the UAD instructions. I am putting the final touches on my Complete UAD Guide now. I've already found many inconsistencies between Fannie Mae's Addenda D and Addenda A, which I think they will have to resolve. Other problems will no doubt be uncovered as the UAD is analyzed, considered, added to software packages, and implemented.

Since UAD updates and corrections appear to be a certainty, you'll be glad to know that we do plan to publish all updates to my Complete UAD Guide as they are released, on our Real Estate Valuation Magazine & BLOG. All subscribers will receive email notifications of these changes when they've been posted. (Subscriptions to REV Magazine Online are free. The update link is at the top of the righthand column.)

I'm frankly surprised by how many of our readers seem to be oblivious regarding this major Fannie Mae-Freddie Mac initiative. They apparently do not realize yet just how complex the UAD requirements are, which go into effect for all Fannie Mae & Freddie Mac URAR appraisals with effective dates from September 1, 2011 on.

Ask Henry

Dear H2,

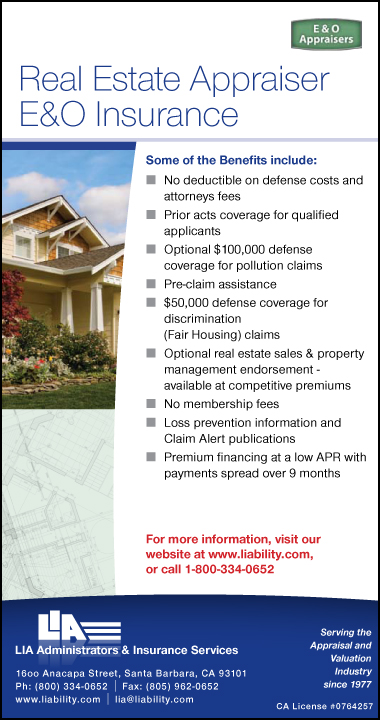

Last week I received an email from Corelogic indicating that I should include their company name on my E & O insurance as the certificate holder if I need to receive orders. Although I have been with them for over 4 years, the past 2 years I have received only 2 orders from them. Is this legal on their part? Am I really obligated to put every AMC we do business with on our insurance? I told them that I will not have their name on my policy and they should get their own insurance. I do have my own insurance with $1 million dollars coverage. Any advice will be great. Thanks in advance.

Sargon Simon

Tri-Valley Appraisal Services

trivalleyappraisal@att.net

Dear Sargon,

It is quite common for companies to ask their vendors to be added to their policies as "additional insured" or to provide a certificate of insurance. I have never heard of this practice being illegal. This is not the same as getting their own insurance, which if obtainable, would be very costly. I suggest that you contact your insurance agent/company and ask what the cost would be to comply with their request and what steps you would have to take to obtain what they want. With this information, you would be in a better position to decide whether or not to comply with their request. My overall advice is that whenever you can do something to accommodate a client, you should try do it if you can, as it builds good will.

Ask Henry

Hi Henry,

I was sent an email by an attorney's office, stating that he is the attorney for one of my clients. He attached an affidavit and requested that I sign and notarize it. Basically, the affidavit is asking that I swear to the value of a report that I had done in the past. Additionally, he asked for a copy of my curriculum vitae.

I replied in an email that he is not my client and as a licensed real estate appraiser, I'm bound by the Uniform Standards of Professional Appraisal Practice; therefore, I can't discuss any aspects of the report with him. He then left a voice message stating he "didn't understand" my email and to please call him. This person is a real estate attorney and also handles corporate law. I'm sure he understood my email. I replied to him in an additional email that he is not my client and I can't discuss any aspects of the report with him. The scope of work on this report was market value and in the limiting conditions it states: "the appraiser is not responsible for matters of a legal nature."

By the way, my client has not contacted me regarding this issue. Do you have any advice on how I should proceed if my client contacts me about signing the affidavit? I appreciate your time and any advice you may have for me. Thanks!

Nola Beehler

snickersdu@yahoo.com

Dear Nola,

The USPAP restricts you from having any dialogue about your appraisal report with anyone except the lender/client who is identified in the report (with a few specific exceptions). In my opinion this includes even acknowledging that such a report exists. I believe the only acceptable answer when asked about an appraisal is to tell whoever asks you that they should contact the lender/client named in the report for further information. If the lender/client wants you to amend the report to include an additional user, it is a change of the scope of work, which requires a new appraisal report. You can comply with such a request -- and charge for your additional time.

In general, whenever you add any information about an appraisal report either in writing or verbally, it becomes part of the report. I would limit any affidavit I signed -- only at the request of the lender/client -- to a statement that you made the report and that the report speaks for itself. When pressed further, I recommend that you refuse to do anything without the advice of an attorney representing your interests, and ask the requesting party agree to pay for the cost of the attorney. Whenever a lender/client asks for additional services you have to decide if charging an additional fee is good business practice. Excessive accommodation may lead to regular requests for "extras", but in the current climate, keeping a good client may require this.

Ask Henry

Dear Henry,

First, thanks for the resources on your web site!

I have been asked to do an exterior-only inspection of a home on a 65 acre site in a rural location for loss mitigation. I have the assessor cards on the property, so I have some basic information, but their last inspection was several years ago. The property is behind locked gates and not at all visible from any point. I have asked to have this assignment upgraded to a full report, but the lender also does not have access and wants to proceed with a driveby only. Can I effectively do this using extraordinary assumptions with so many unknowns?

Tom Trojnar

ttrojnar@earthlink.net

Dear Tom,

This is a judgment you have to make.The USPAP requires that you make a credible appraisal. I would tell the client (preferably in writing) what extraordinary assumptions will need to be made to do this assignment, and get their pre-approval (again preferably in writing). Keep in mind that this appraisal may lead to a variety of problems and the lender may blame them on you. You need to ask yourself if it s important enough to your business relationship with the client to expose yourself to possible future trouble that may occur. Finally, the type of report does not have any effect on what you have to do to make a credible appraisal.

Good luck!

Ask Henry

Dear Henry:

On page one of the FNMA 1075 form is a section titled "Project Site". At the conclusion of this section, the following question is asked of the appraiser: "Are there any adverse site conditions or external factors (easements, encroachments, environmental conditions, land uses, etc.)?". Question: If the subject of the appraisal is located on the perimeter of the condo complex and fronts onto a traffic street, while a majority of the remaining units are located within the interior of the complex and are not impacted by any traffic noise, is the answer to this question "yes" or "no"? In the past, I've always looked upon this section of the report as focusing more on factors that would "impact the complex as a whole", for example, an easement for high power lines that run through a complex (EMFs), or a complex that was built upon a site that has an abnormally high water table and resultant wet basements.

Dennis J. McCarthy

djmccarthy@cox.net

CA State Certified Res. Appraiser

Dear Dennis,

In my opinion, when in doubt about anything that might be adverse to a property, you have to report it. In this case, there are some problems that affect part of the site where your subject unit is located. You should report this, and then go on to explain how the problem specifically affects the subject unit you are appraising, in terms of desirability and competition in the market.

As far as "Yes" and "No" answers go you must be very careful about checking the "No" box. It is much safer to check the "Yes" and indicate with a asterisk that in the comments section or the addenda there are comments that explain why you checked the "Yes" box. Here you can explain what effect (if any) what you are reporting has on the value of the subject property.

Ask Henry

Good Morning, Henry,

I am doing an appraisal on a property that is a model home center. The buyer is leasing back the property to the seller for a period of at least 12 months. This is stipulated in the contract, and I am wondering if the leaseback is considered a Sales Concession and inserted on page 1 of the appraisal report under Seller Concessions since the buyer is in effect contracting with the seller. The seller is paying 2% of the buyer's closing costs which obviously is a sales concessions, but I'm unsure if this is the area of the report where I should insert the information regarding the leaseback as well. The purchase price is $550,000 and the monthly leaseback is $5,350.

Thanks in advance for your input,

Ben Powell

bpowell7@tampabay.rr.com

Dear Ben,

In answer your question, paying 2% of the buyer's closing costs is not a very big sales concession if the seller is going to get to use the property for another year. However, if the rent the seller is paying to the buyer is above market rent, then that would make it a sales concession as well. You need to consider both the payment of part of the closing costs and the terms of the leaseback in order to decide if it is a sales concession. Then you have the tricky job of putting a dollar value on both types of sales concessions.

If you think the leaseback rental is above market rent, then it is a seller concession. It is a judgment you must make based on comparable rentals in your market area. What about the price? Was it adjusted downward so the developer could have the use of the house for the year? If so, that would also be a type of sales concession. My advice is to carefully note each of these concessions separately, including all terms that apply, along with your opinion about their impact on your value estimate for the subject property. Where you put the information is less important than being sure you are including it all. You may do best if you add a custom addendum regarding the concessions.

Ask Henry

Greetings Henry,

Over the years I have appraised a few rural properties that have possessed small vineyards. In every case, the owner has claimed the vineyard was not for commercial use, it was for hobby use only -- or, that there was only a very small "incidental income" attributable to the vineyard. Is there any hard criteria that can be applied in determining if the highest and best use is commercial wine production, based on the # of vines, etc. In discussions with other appraisers, it has always seemed to be a grey area with lots of appraiser discretion.

Regards,

Rick Bacich

rickbacich@mail.ssctv.net

Dear Rick,

My daughter Kate did her college thesis at Vassar based on a survey of organic farms in the Hudson Valley in upstate New York, which is a wealthy semi-rural area. Her conclusion was that after you assigned some cost to the labor by the owners, the farms were not making any money at all! A well-known real estate author moved south with her husband to run a vineyard they had purchased. When I saw her at an educators' convention, she lamented that she made more money selling the grapes from a farm stand than she could by producing wine. Last I heard, they'd sold the vineyard and given up. There's lots more anecdotal evidence that indicates what the owners are telling you is true.

You might try the Lum Appraisal Library, 550 W. Van Buren Street, Suite 1000, Chicago, IL 60607; (312) 335-4100 to see what has been published on the subject. The librarians there are knowledgeable and helpful.

Ask Henry

Dear Henry,

For the first time in my 26 years of appraising, a complaint regarding the quality of my work has been submitted to the Better Business Bureau. I am compelled to answer the complaint, which involves 2 different clients. My only concern is that my response will be on the webpage for everyone in the world to read. Will I be violating USAP Standards on confidentiality to my clients? Please give me your thoughts.

LJW

Information withheld by request

Dear LJ:

There is nothing I know of that compels you to answer this complaint. However, if you decide to answer it, I recommend saying that the appraisal is your professional opinion, and that the confidentiality provisions of the USPAP prohibit your discussing the appraisal with anyone other than your client.

Ask Henry

Dear H2,

I am appraising a condo where the mortgage is held by a small bank in the developer's portfolio. The original appraisal was for $1,623,424 a few years ago. The bank requires that these appraisals be redone every few years. This is a 3,905 sq. ft. very upscale penthouse with a private elevator. It is on the fourth floor of a four-story building with a woodland view, but is just a five minute walk to one of the largest shopping malls amd upscale business centers in the greater Atlanta area. Location is excellent. The value of the condos in the subject building have declined as out-of-town buyers have walked away from what they thought were rental investment properties. The original prices were from about $750,000 to $1,700,000. After a series of foreclosures, the units have been selling for $200K - 300K and a few lower. I have a comp less than a mile from a competing building that is $2,024,300. It is almost identical to the subject unit, but has no elevator. Other than that, there's nothing anywhere close by. Also, taking into consideration the state of the subject condo, I just don't know where to start to do this appraisal. The workmanship is excellent and this five year old unit which is owned by the developer is like new, as he has hardly ever been there. I have not ever been faced in 28 years with such a challenge. Could you give me some guidelines?

June Ortiz

june.ortiz@comcast.net

Dear June,

What you are describing is happening in many market areas throughout the country. What makes your question difficult is you offer no explanation of why the one comparable sale seems to be so different from the rest of the market in which your property is located. Your appraisal has to be based on all of the known comparable sales in your market area from which you select the ones that you believe are most comparable. What the subject sold for historically must be reported, but has no bearing on its current value. You have to make a judgment as to how much weight to give this one sale that seems to differ from the rest of the comparables in the subject condo complex. At a minimum, you must verify that sale and try to find out from your verification source(s) why the buyer was willing to pay so much money.

Ask Henry

Dear H2,

I am looking for a copy of your book entitled Harrison’s Illustrated Guide How to Pass the AQB Residential Appraisal Certification Exam. I have been unable to find it in any book stores. Any help would be great!

Thank you,

Eddy L. Arnold

eddylarnold@wi.rr.com

Dear Eddy,

The current edition of this book -- and any of my other my other guides and books -- is available from Forms and Worms, online at: www.formsandworms.com or you can call them toll-free at: 1-800 243-4545.

Ask Henry

Dear H2,

On a current appraisal, after all adjustments are made in the sales comparison grid of the URAR, the end adjusted values are as follows: Comp1: $125,000 - Comp 2: $127,000 - Comp 3: $124,000. I am unable to accord weight to any one of the comparables and would like to give weight to all of them, using an average that is in the middle of the indicated value range ($124,000-$127,000). I would like to add all three indicated values, and divide by three (= $125,333 average) and then reconcile the values to be $125,000.

However, I’ve been told many times not to derive an opinion of value using a mathematical method such as this one. Yet I have seen a few appraisals of my peers that do use this method, where appropriate. Of course, I want to be in compliance with Fannie/Freddie and USPAP. What's your opinion?

Brooke

Dear Brooke,

If you are using a URAR form, the format calls for you to describe each comparable sale and then adjust it for any significant differences between it and the subject property. However, there is nothing in the USPAP that requires you to analyze comparables this way. In more complex appraisals (usually reported in a narrative appraisal report format), I have seen large sets of comparable data adjusted using averages. What you plan to do is fine, but the final value estimate of the subject should be based upon a reconciliation that, in your judgment considers everything about the subject, market and comparables that you think is significant.

The reason an "average" is not usually used by appraisers in the reconciliation process is that it is a statistical term that implies that you took a random sample of all the available comparable sales, and that the sample was large enough (usually a minimum random sample is at least 18 items). You would then also need to state if the average you obtained is the mean, median or mode.

Ask Henry

Dear Mr. Harrison:

This is my first question for you. I'm a Certified Residential appraiser in MA and N.H. Can I just go to the govt. website to become FHA approved? Is it that simple? Could you advise me please? I enjoy your Revmag emails I receive.

Thank you in advance for your help.

John D. Devereaux

jaydev@charter.net

Dear John,

The FHA website: http://www.hud.gov/offices/hsg/sfh/appr/eligibility.cfm tells you in detail what you need to do to get on the FHA Roster of Approved Appraisers.

If that doesn't work, go to Google and enter the phrase "FHA Appraiser Roster". There is an application but is cannot be completed online. Your completed application must be submitted online, which means that you have to download the application and save it as a PDF, sign it and then scan it and send it back via email to the FHA.

Here are the highlights of the current FHA requirements:

1. You must be a residential certified appraiser or general certified appraiser.

2. You must NOT be listed on GSA's Excluded Parties List System (EPLS),

HUD's Limited Denial of Participation (LDP) list, or HUD's Credit Alert System (CAIVRS).

3. You must scan your state issued certification and send it with your complete online application.

4. Make sure that the ASC National Registry contains the correct information about your certification.

The $64-thousand dollar question is what happens next! Hopefully some of our readers will share their experience -- especially how long it took them to get on the FHA roster once they had applied.

Good luck!

HSH

askhenryharrison@revmag.com

Ask Henry

Dear Henry,

I am appraising a home that is yet to be completely finished. The subject is a new construction property, and the owners are looking for permanent financing. One staircase is missing a handrail; however, a door at the top has been blocked-off in order to prevent anyone from using the stairs. (I know in the past handrails were required on anything over three steps, but is that still the case?) Also, the balcony railing has yet to be installed, but a temporary railing has been securely attached to the balcony; is this acceptable per Fannie Mae guidelines? Barricading the door and the temporary balcony rail do meet our local codes.

Thanks!

Mark Faldetta

markfaldetta@gmail.com

Dear Mark,

In general, Fannie Mae requires that the house be complete prior to finalizing longterm financing. You should describe any items that you observe that are not complete. You should emphasize any unfinished items that present a safety hazard. If required by your scope of work agreement with the lender/client, you should provide an estimate of what it will cost to complete the house. If you are in an area where a Certificate of Occupancy is issued by the local building authority, you should report on whether one has been issued, and if it contains any conditions regarding what must still be completed.

Ask Henry

Dear Mr. Harrison,

I'm a residential appraiser in New York, primarily covering the five boroughs of New York City. I come across many homes that have upgraded kitchens and bathrooms, finished basements, finished attics and/or small extensions. Many of these upgrades are not filed with the City, and I've been getting requests from lenders asking if these are 'legal' upgrades or additions. I have spoken to the NYC Building Dept. and their response is almost always the same: they would need to send an inspector to the property to determine the legality of the upgrades (ast no work permits have been filed). I have two questions:

1) Say there are no work permits allowing for the upgrades that are already in place, can I still add value for the areas that were upgraded? Can I include the extra square footage, the finished attic space, etc., in the area above grade? And can I apply adjustments for kitchen remodeling or other upgrades if there were no work permits for the upgrades?

2) Is it my duty as an appraiser to notify the lender that there were no permits filed for the work?

Thank you for all the insight and help you provide! I await your response.

Nechama D. Arnold

Arnold Appraisal Group, Inc

arnoldappraisals@gmail.com

Dear Nechama,

Millions of home improvements are made every year without building permits. Most appraisers don't get into the legality of an improvement they observe, unless they have some reason to suspect that it was made without a permit. In that case, they would be required to report their suspicions and comment what effect -- if any -- this has on the value of the property. I would be very careful about interviewing an owner. The safest thing you can ask would be, "Is there anything you would like to tell me that you think would be helpful to me in making this appraisal?" The problem is that they will start to ask you questions about the appraisal, and unless the lender/client has authorized you to discuss the appraisal with the homeowner, it is a violation of the USPAP to do so.

All things being equal, what you see is what you appraise. However, if you suspect the property is an illegal use, you must report it and state the basis of your suspicions. It is appropriate for you to ask a building inspector for a record of the permits that have been taken out on any property that you are appraising — but not ask if there is a permit for any specific upgrade. If this triggers an inspection, you and your lender/client run the risk of getting sued. You should quote the building inspector if you think what he told you was significant.

I think an appraisal report should speak for itself. I would think twice before volunteering to a lender/client any information that was not in the appraisal report. When a lender asks you specific questions about your appraisal, you probably should answer them preferrably in writing, and only if the information is not confidential. This is the problem with interviewing homeowners. If they give you some negative information about the property, and then say it is confidential, you are in a professional Catch 22. You are obliged to report negative information about the subject, but you are also required to respect confidentiality.

Ask Henry

Dear Henry,

I am seeing appraisers applying time adjustments in a wide variety of ways. It would be good if everyone were on the same page!

The Fannie Mae guideline on time adjustments says that if the sale is over 3 months old, you should apply a time adjustment. Does this mean that if the sale is under 3 months old, no time adjustment is required, even though the market is declining? Should the time adjustment be from the date of contract to the subject appraisal date, or to 3 months prior to the subject appraisal date? I have been unable to find an answer to this question anywhere. I am making time adjustments on all comparables up to the effective date of the subject appraisal, but don't know if I am being overly conservative. Thank you in advance for your help.

Toni Stiffler

tstiffler@comcast.net

Dear Toni,

The Fannie Mae guidelines (which Fannie Mae points out are just guidelines, and not mandatory requirements) suggest that a time adjustment is desirable for comparable sales that are over 3 months old. When you don't comply with a Fannie Mae guideline, I recommend that you put a comment in your appraisal report explaining why you made this decision. This will be helpful to readers (and reviewers) of your report. This 3-month guideline does not imply that a time adjustment is unnecessary when the period is less than three months, if the appraiser thinks one is necessary.

Ask Henry

Dear Mr Harrison:

Thanks for sharing the wealth of your knowledge and experience with all of us; we look forward to your publication!

My question: I am completing over forty years of successful activity as a Realtor. Now, at 87 years, the body is getting weary and many daily showings are tiring -- but the brain loves the business. I think I'd like to be a certified appraiser in the State of Ohio -- but at my age I'm not sure I could satisfy the apprenticeship requirement in a timely manner.

Your advice would be appreciated!

Name and email withheld by request

Dear Friend,

I am 80 myself, and will be happy if I make it to 87 and still can continue working! Frankly, I think it is a little late for you to be starting out as an appraisal trainee. However, with your background, have you ever thought of becoming a real estate consultant? You might start by offering your services to give some home buying advice, perhaps in a free seminar at your local library or civic center? There are also good opportunities for "seniors" like us in the Service Corp of Retired Executives (SCORE), where your expertise in real estate might be very welcome. SCORE is a national non-profit organization that counsels business owners and aspiring entrepreneurs. There are nearly 400 SCORE chapters throughout the United States offering counseling services to small businesses in all areas -- at no charge to the client. Find out more about volunteering for S.C.O.R.E. here: http://www.score.org/volunteer.html

Good luck -- and let me know what you decide to do.

Ask Henry

Dear Mr. Harrison,

I have received and read REV since its inception. Thanks very much for the opportunity to use this great resource!

I am writing regarding the recent “Ask Henry” entry entitled: Fair Market Value, Market Value, IRS Value. I wonder if the U.S. Code of Federal Regulations (available online at http://www.access.gpo.gov/nara/cfr/cfr-table-search.html#page1) could be of use in resolving this question. For instance, in appraising real property for estate settlement, I use the definition of “fair market value” found at Section 20.2031–1(b), Part 20, Chapter I, Title 26. (This is under, “Estate Tax, ; estates of decedents dying after August 16, 1954” and “Definition of gross estate; valuation of property”.) The definition found there is, “The fair market value is the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.” Since USPAP requires that we also cite the source of our definition, I am able to give the appropriate citation as set out above. Would you concur with this methodology?

Thanks again for a great magazine/blog.

Best regards,

James P. Johnston

Wauneta, NE

Dear James,

I looked at the site and I think it is potentially a great resource for an attorney. However, I found it not useful as far as helping an appraiser determine what value to use. I entered each search term: "Market Value", "Fair Market Value" and "IRS Value". In each case, I got 200 references, which is the maximum it will give for one search. This means that I would have to read and understand 600 documents -- and it does not preclude the possibility that there might more. I need to stick to my original advice: for mortgage purposes, the FIREA definition must be used, and it is a useful definition for many other types of mortgages too. I would recommend that appraisers do not try to offer any other definition of value. This should be up to the lender/client, hopefully with the help of their attorney, and should be fully communicated to the appraiser as part of the required scope of work dialogue. The problem is that once the definition of value is changed, it requires selection of comparables that were sold under conditions that meet this atypical definition -- which is a good trick if you can do it.

HSH

askhenryharrison@revmag.com

Ask Henry

Dear H2,

I am appraising a four unit property that has all four units rented. Page 1 asks me the property rights. Do I check leasehold, fee simple, or other. There are some education courses stating that if one of the units is rented, then it is leased fee and the appraiser should check the box “other” on page 1 and call it leased fee.

Leasehold estate is defined as the right to use and occupy real estate for a stated term and under certain conditions that have been conveyed by a lease. Leased fee is defined as an ownership interest held by a landlord with the right of use and occupancy conveyed by lease to others; usually consists of the right to receive rent and the right to repossession at the termination of lease. In theory, this would be true, as the subject is rented at time of appraisal report.

My question is what is the appraiser supposed to mark at this time? If it is a leasehold, or leased fee, does the appraiser then mark the comparables as leased fee if the appraiser can verify leases? What if the appraiser cannot verify the leases for the comparables — are they then marked "fee simple"?

What is page 1 asking? Aren't they asking for the rights that transfer if the property sells? Would it not be common for the complete rights to be transferred with the Leased Fee interest referring back to the Leaseholder at the time of transfer; therefore, wouldn't the transfer be fee simple as the whole bundle of rights are transferred to a new owner?

What is the correct way in the eyes of Fannie Mae to complete page 1 if the subjects 4 units are under lease? I need some definitive clarification on this as I am seeing many different takes on this. I have always considered such properties "fee simple" because the duration of the leases are short term. I am not addressing land leases. Owner of land is also owner of the improvements, who is leasing four units to renters on a yearly lease. Please help!

Thank you,

Ron Coffman

ron.coffman@streetlinks.com

Dear Ron,

It sounds like you are doing a mortgage appraisal that is going to be sold to Fannie Mae or Freddie Mac. They are only interested in property that is owned in fee simple, so that is what you should indicate on the form. If there is a long lease on the property, at some rent other than market rent, you would have to deal with the possibility that there is a leasehold interest on the part of the tenant. That is very unusual in a four family dwelling.

However, when you appraise any property that is leased, you have to be careful that there is nothing unusual in the lease. I recommend — as part of your dialogue with the lender/client — that you tell them you must have copies of all the leases. If they are not obtainable, you are going to have to say this in the appraisal report, and then make some about the key features of the leases. This is not going to make anyone happy. If you decide go this route, you should get permission in writing to do this from the lender/client before you proceed, only to find out later that the appraisal is not acceptable to them. If you are, in fact, doing a leasehold interest appraisal, you need to have a clear understanding with the lender/client as to what you are doing and for whom!

Ask Henry

Hello Henry!

Great Mag & Blog. Thanks for your hard work.

Let me ask you, do you calculate vacancy based on a time period or unit basis for muti-family/commercial properties. I have a 20 unit mixed use building, with 3 retail spaces and 17 apartments. One of my retail spaces and 2 apartments are vacant going on 3 months now. So is my vacancy rate 6.6% or 24.9%?

G James Gervas

ggervas@yahoo.com

Dear James:

Thanks for your kind words.

Normally vacancy rates are reported on an annual basis. It is not based on your current rate but rather on an historical fact. It is like the income and expense statement where you are forecasting a typical year, rather than reporting a "blip". Most likely it will not be either of the figures you are suggesting, but rather, a composite of the past years average vacancies. For example, if your monthly vacancy rate is approximately 24.9% of the total space, for 3 months, but nil for the rest of the year, the vacancy rate would be 6.2% for the past year. (24.9% x 3 months = 74.7 + 0 divided by 12 months = .0622). However, you should be considering more than a single previous year.

Ask Henry

Dear Henry,

As a federal statute, who or what government entity is charged with enforcement of the Financial Institutions Reform Recovery and Enforcement Act of 1989 (FIRREA)? If an appraiser is aware of activity specifically prohibited by the statute, to whom should such activity be reported? It would seem nonsensical to have a federal law that was unenforceable by either the US Attorney General or the FTC or the EEOC. If you are unaware of a specific entity to approach, could you suggest a course of action in order to discover the appropriate party? Thanks for the favor of a reply and thanks for publishing my editorial response in your initial blog issue.

Peter von Nessi, CSA-G

normandygroup@optonline.net

Bronx, NY 10465

Dear Peter,

The way I remember it is that FIRRA established the government agency call the Appraisal Subcommittee. About the same time, the national appraisal organizations finally got motivated and established The Appraisal Foundation, which was given the mandate to write Appraisal Qualifications and Appraisal Standards for the profession. The Appraisal Foundation received financial aide from the Appraisal Subcommittee to accomplish these tasks. The actual task of licensing and certification of appraisers and the power to investigate complaints about appraisers was left up to the individual Appraisal Commissions that each state was required to establish. The duty of supervising these Commissions was left up to the Appraisal Subcommittee. It is their responsibility to see to it that the individual state Appraisal Commission carry out their duties. Therefore, if anyone had a complaint about an appraiser, it was supposed to be reported to their state's Appraisal Commission. If the problem were with a lending institution, it could be reported to the State Banking Commission or if a federal criminal offense were being committed, to the FBI.

Today, there is a big difference in the way these complaints are handled. In some states, little or nothing ever happens regarding follow up on complaints. In contrast, other states go overboard trying to enforce the regulations. Most states fall somewhere between these two positions. The best way to find the most effective avenue for getting your complaint dealt with seriously is to contact your state's real estate appraisal commission and ask for their advice.

Ask Henry

Hello Henry,

Thanks in advance for taking the time to answer my question.

I have a client who's requesting a market value and a disposition value on every commercial report. If you were asked to do this, what steps would you take and how would you go about coming up with your disposition value? Thanks again.

Robert Jones

robertjones56@bellsouth.net

Certified General Real Property Appraiser

Dear Robert,

The USPAP requires that every appraisal include a statement as to what value is being estimated and a definition of that value. When you use the URAR, the form takes care of this with a statement that the value being estimated is market value, and provides the federally-approved definition of market value. In your scope of work dialogue with the client, you will need to agree on a definition of disposition value. Such a value would consider the typical marketing period, which would likely be different from the typical marketing time used for market value. It also might include how the property would be marketed — perhaps utilizing an auction or some other atypical method. One you have the definition, you will have to find comparable sales that meet those conditions.This often severely limits the availability of comparable data. You could contact the Lum Library of the Appraisal Institute in Chicago at (312) 335-4100 for any published definitions of disposition value.

Ask Henry

Dear Mr. Harrison,

I have been asked by an attorney whether there is any difference between "Fair Market Value" (a term he sees in IRS rules and regulations) and "Market Value" as used in appraisals. I have told him that the term "Fair Market Value" has been superceeded by the term "Market Value," but he is still concerned that there could be some value difference attibuted to the use of one term rather than the other. Can you help me clear this up for him please? Thank you!

Donald

apps1@compfxnet.com

Dear Donald,

The definition of "Fair Market Value" is contained in the FIRRA Act and is required for all mortgages where the U.S. government is involved. It is the value most often estimated by appraisers. Keep in mind that the USPAP requires that every appraisal state the type of value being estimated and provide a definition of that value. Different IRS publications and regulations seem to include different definitions of the terms Market Value and Fair Market Value. I suspect that if you based your appraisal on one of those definitions, the value you estimated might differ from an appraisal based on one of the IRS definitions. The attorney is going to have to research which of the IRS definitions applies to the matter they are involved in, and if an appraisal is needed in the case, be sure to supply the appraiser with that definition of value.

HSH

askhenryharrison@revmag.com

Ask Henry

Dear H2,

I have an assignment for a retrospective field review, dated March 2006. I have asked the AMC to provide the intended use of the review appraisal. Their response is that they did not get this information from the Lender. My initial thoughts about responding to this situation are to: (a) clearly state this condition in the report; and, (b) provide an assumption of the intended use for the review and condition a possible revision if the assumed intended use is not correct. Is this the right way to proceed?

David L. Prymak

dlprymak@dlprymak.com

Dayton, TN

Dear David,

Statement 9 in the USPAP goes into detail as to why the appraiser must know the intended use of the appraisal. I am not aware of any exceptions to this rule.

Ask Henry

Hello Henry,

I have been an appreciative customer and fan of your publications for decades. However, in your current online REV Magazine where an appraiser is complaining about having to take lots of comp photos, I submit the following sample of a letter received from one of our clients in this regard:

"There is commentary in the Addendum stating: "Some MLS photographs are used for comparable sales, as it had not been determined at the time of the property appraisal inspection which comparables would be most appropriate to use in the sales comparison approach." In the Appraiser's Certification, under Scope of Work (#3) [typically page 4 of the URAR form], it states: The appraiser must inspect each of the comparable sales from at least the street. Please address whether or not the appraiser inspected the comparables used in the appraisal report.”

Our clients insist that if the appraiser inspected the comps (as the Appraiser’s Certification indicates), then why couldn't they takea picture to show they were there? They can provide MLS photos in addition, if they better represent the property. Hopefully you can get the word out as to why this is simply good practice, as not doing so can delay the mortgage process.

Respectfully,

A Concerned Fellow Appraiser

Name and email withheld by request

Dear Friend:

Keep in mind that the USPAP does not even require the the property be inspected. The URAR Fannie Mae #1004 - Freddie Mac #70 was created by Fannie and Freddie to codify some of their "Scope of Work" requirements which they require from Lenders selling mortgages to them.

I agree that in this age of digital cameras (and camera enabled cel phones) it would be prudent for the appraiser to photograph every potential comparable sale they inspect, and then select those photographs later for the comparable sales they use in the report. If the MLS photograph provides better information about the comparable sale, it should also be included in the report. The USPAP requires that there be a dialogue between the lender/client or their representative as what they require for each appraisal. This would be the appropriate place for the photo requirement to be communicated to the appraiser.

Back in the 1980s, we had a large appraisal company which at its peak had about 50 appraisers. This was before digital cameras were common. We had special 35mm cameras that recorded the date, time and address of each photograph. We required that our appraisers photograph every potential comparable sale when they inspected them from the street. We also keep all of these photos in the permanent work files. It was costly at the time, but in our judgment a worthwhile requirement. Now, with digital cameras and cheap CDs, mini-zip drives, and other storage capacity, I recommend that all appraisers follow this procedure.

Ask Henry

Dear Henry,

How long should you keep a file "active"? One of my AMC clients was always asking me to go back and "review a file". They'd give me new comps and other "new data". The last time this happened, the file was completed over 2-1/2 months previously. I told them the file was "beyond a reasonable period of time" for an update, or another "review". I explained that from then on, I would need to charge them a fee of $50 each time I had to go back into "closed" files. They got upset with me!

I think a reasonable period of time to question an appraiser is during the time that the file is in underwriting, and up to a week after the report has been delivered to our client's customer. After that point in time, when someone asks me to look at more comps, I feel that they should be charged an additional fee (from $25 to $50). It usually takes about 30 minutes to 1 hour to review additional info and (usually stupid) comps.

My point is that you do not go to a doctor for free, so why should an appraiser do additional work for free, after a reasonable period of time has elapsed? Isn't my time also worth $$$? I think it is sad that some appraisers are willing to work for nothing! By the way, this customer does not send me any busines anymore.

Brian Brown

bbrown09@bellsouth.net

Dear Brian,

I am not sure what the difference is between an open and closed work file. The USPAP requires that you retain a "complete work file" for at least five years after an appraisal is made, plus an additional two years after the end of any litigation that involved the appraisal. Many appraisers find it easier to just save the whole file and keep it accessible during this period. This is especially true now that the cost of computer storage is so low, and most appraisals are stored digitally.

I understand that you are upset, and feel that the client abused you one too many times. Frankly, I think this is a business judgment. When a good client asks for reasonable things, it usually is not a good idea to charge them, or protest. When the request is from a one-time client, you might consider adding an extra fee. Personally, in my own appraisal practice, I rarely charged an additional fee, as my theory was that treating all clients well and keeping in touch with them — even if it was just answering what I considered to be an annoying question — was good for business.

By the way: I happened to call my doctor recently, to ask for specific information from my patient file. The information was faxed to me, and I was not charged.

Ask Henry

Dear H2,

I recently lost a major client because I tried to tell them they were wrong. A valuation company, representing a bank, asked that all subjects with five acres or more ONLY be appraised with five acres, and anything over that should not be included in the appraisal. Also, if there were outbuildings, I was instructed not to include them in the grid, but only comment about their existence in the addendum.

I said I would only do this on a non-financial appraisal form. They refused, claiming as their reason that "not all appraisers have access to non-financial forms". After further research and agreement by various industry trainers and the Appraisal Foundation whom I consulted on the problem, the valuation company still said I was in the wrong, and fired me from their assignments. I lost thousands of dollars worth of work. Who is correct? And what can I do?

Launa Tierney

jobinlt@yahoo.com

Dear Launa,

There is nothing in the USPAP that requires that you appraise all parts of a contiguous property. In all circumstances, however, your appraisal would have to make it clear that your appraisal was of only part of the contiguous property. As far as what the valuation company is asking you to do, the answer is that the USPAP says that you cannot make an appraisal that intended to deceive anyone (for more details look in the USPAP index "Misleading Communication.") It appears from your question that the valuation company wanted appraisals that would mislead Fannie or Freddie, who would not buy these mortgages if the knew about the extra acreage. I think you should go over their heads (or threaten to go over their heads) and send letters to the chief appraiser of the lenders whom they represent, telling them you have lost their business because the valuation company wanted you to violate the USPAP.

Ask Henry

Dear Henry,

A larger appraisal management company is now requesting that the comp photos be recent to the season in which the appraisal is being completed. If a home is being appraised in the summer, they do not want comparable photos with snow or fall colored leaves on them.

How many times can an appraiser afford to retake old comp photos with gas at $3.15 a gallon, never mind the time consuming effort of going there in the first place. Some of my comps are in rural areas where each one could be 20-30 miles away from the other.

Is this a legal and legitimate request?

Jean Black

jeanblack@echoes.net

Dear Jean,

Often AMCs do not realize that their requests substantially increase the appraiser's costs. The USPSP requires that you have a scope of work dialogue with the lender/client. Unless something they requests conflicts with the requirements of the USPAP they are not in my opinion illegal or illegitimate. You really have four choices as to what to do. 1. Try to talk them out of the requirement. 2. Tell them that it requires extra work for which you expect extra pay. 3. Do what they request. 4. Refuse to do the assignment.

Ask Henry

Dear H2,

I have been a Realtor for 25 years. I am not a broker. I have recently taken a job with the County as a property tax assessor in training.

The assessor job offers benefits, steady employment etc. I thought I could give up Real Estate sales, but it is not that easy after 25 years. I could see where there would be situations where I would have to morally (if not legally) recuse myself, but for the life of me, I cannot see why I cannot help people to purchase a home after hours or on weekends -- just like a Realtor/Broker can appraise property, do CMAs, and then help someone to buy that same property. Disclosure would have to be made of course. I just started as an Appraiser Trainee, and will be going to CPE classes to get my license. I will have to make a decision soon as to my staying with the Assessor Position. The extra income from Real Estate sales is important to my family.

Is there any conflict of interest, if I wanted to do property assessing full time, and still sell real estate part time?

Dear Mike,

This problem has come up many times before. Many municipalities will not permit someone like you to "wear two hats". However, some do. It is all a matter of "appearances" -- and with assessors it is especially a problem. Many people do not like their tax assessments and think their neighbors got treated better because they had some kind of connection to the assessor. If you decided to do this work, you must get written permission from the municipality for which you will be assessing.. Even then it is not 100% safe. Your reputation may suffer.

Ask Henry

Hello Henry,

I am developing a retrospective field review with an opinion of value for investigative purposes. The effective date is 4-1/2 years prior and the subject and all (three) comparables were investor rehabs/resales in an economically distressed neighborhood, with price increases of 50 - 60% within 3-9 months.

The main issue with the report under review is data verification and the credibility of the comparables' cash equivalent sales prices. Primarily, no 3rd party verification sources were cited and it does not seem that financing concessions were properly verified or adjusted for if they did exist. Seller-assisted financing was common in the market at that time. Most weight was given to Sale #1 which did not have an MLS listing. Sale #2 had a potentially unsupported 8%+/- upward condition adjustment for 'avg' vs 'good' condition; this sale had a "blank" listing #, but also had a 60% price increase within nine months, indicating that it may have rehabilitated in a manner similar to the subject. My research has revealed two sales that support the original value that have no MLS listings; and other "blank" MLS listings that appear to have been investor rehab/resales. I cannot verify these sales or the conditions of the sales in the normal course of business after an elapse of 4-1/2 years. Is it acceptable to use these sales in developing my OMV with the extraordinary assumption that they had no sales concessions that affected their prices? Or by using these unverifiable sales would I be committing the same poor practices found on the original report i.e., the pot calling the kettle black??

Thank you for your time,

Michael A. Ciaccio

Certified Residential Appraiser RD6539

macappraisals@gmail.com

Dear Michael,

I can only give you some general advice, as it is my policy not to comment on specific appraisals.

- It is up to the appraiser to select the most comparable sales. There are no USPAP restrictions on how this is done.

- It is up to the appraiser to make whatever adjustments are needed, keeping in mind that using unsupported adjustments can lead to trouble as the USPAP requires that the appraisal be credible.

- The USPAP has specific instructions about using "Extraordinary Assumptions" (2010-11 USPAP U-3 & U 18). From what you say, they may be appropriate in this instance. Be sure to follow the disclosure requirements.

- You must decide if your report is credible. If there is a reasonable doubt in your mind about its credibility, you should not make the appraisal, as it would violate USPAP to do so.

Ask Henry

Hello Henry,

It appears that some lenders are requiring an estimated economic life on all appraisal reports (even for 1073 form reports on Condos). I understand that banks are using this to determine if the life of the loan exceeds the economic life of the subject. The problem is that economic life is dependent on the owner's maintenance. If, say, a new owner doesn't have the funds and/or knowledge to repair a roof leak or get rid of termites, the economic life could easily go from 50 years to five years. Conversely, a well maintained building can last hundreds of years. How is the appraiser supposed to determine the owner's level of future maintenance? I could not find any reference to estimated economic life in USPAP.

Ken Janke

kenjanke09@gmail.com

Dear Ken,

I think you should make it clear in your definition of estimated economic life that it includes the assumption that the property will receive normal care and maintenance.

Ask Henry

Hello Henry,

First of all thanks for all the information you publish. I have read several of your books and they were all very informative.

Now for the question: Are appraisers responsible for assuring that construction permits were issued for any construction on the subject property? As far as I know, we are responsible for determining whether the property is a legal use, grandfathered, or illegal. However, I really don’t think that researching construction permits is the responsibility of the appraiser. This is the request I've received regarding the property, directly from the Lender.

"There is a discrepancy between the GLA stated by the appraiser and the GLA stated in public records. The appraiser is asked to explain. If additions were made, were final permits obtained? Appraisal reflects 2037 sq ft while public records reflect only 1898 sq ft. Public records also reflect a year built of 1926 but appraisal reflects 2008. Was the subject recently totally rebuilt? If so, was it completed with the proper permits?"

What should I do?

Thanks,

Leading Edge Apppraisal

info@leanj.com

Dear Friend at Leading Edge:

When you are appraising a new home, you should consult your lender/client as to how much investigation they want you to do. You may wish to charge extra if you have to visit a record center to obtain building permits and occupancy permits. For older houses, you normally would not do this unless it is customary in your market area or you suspect there is a problem.

The Fannie Mae/Freddie Mac forms ask for your opinion about the zoning. You need to do whatever is necessary to offer a correct opinion.

In most areas, it is expected that the appraiser will accurately measure the house. Relying on others is looking for trouble. If you accurately measured the house, you would respond by stating that is what you did, and what you found the GLA to be.

It is worrying that an appraiser would mistake a 1926 house for a 2008 house, no matter how much remodeling was done!

HSH

askhenryharrison@revmag.com

P.S. Thanks for the kind words. We always appreciate reader feedback.

Ask Henry

Henry,

I'd like to get your insight into how you would adjust for lakefront footage. Obviously more is better and more valuable -- but at an incrementally diminishing rate per linear foot, right? For example, take two identical properties, except that one has double the lakeshore of the other, 200' versus 100'. Clients seem to think the second 100' should be adjusted at the same rate as first 100' and have been asking for report revisions! Often they want the footage to bracket the subject, and can't understand why the parcel with more frontage is adjusted at a lesser rate per foot than the parcel with less. What should I say?

Dear S:

There is no benchmark or rule that I am aware of that works. You have to find some matched pairs of sales in your market area upon which you are going to base this adjustment. I don't think you can jump to the conclusion that sales with substantially larger lakeshore frontage require a smaller square foot adjustment without some evidence.

Ask Henry

Dear Henry,

In the following definition of Comparable Sale, what would you consider to be a reasonable "nearby" distance?

Comparable Sale: A comparable sale is a property, that is similar to the subject property in most respects, is located in a similar (nearby) location, and has sold recently at arms length. The selection of comparable sales is in most residential appraisals, the single most important determining factor in establishing value. It is the appraisers responsibility to adequately research the local real estate market and determine which comparable sales best represent the value characteristics of the subject property.

Benson J. Bercovitz

bercovitz@aol.com

Dear Benson,

There are no benchmarks or USPAP rules that determines what is a reasonable distance to look for comparable sales. Often it is just a few blocks from a university, hospital or some other work place where many people in the market are motivated to live, to be nearby these facilities. On the other hand, when corporate executives are relocated to New York City, they often check out housing in New York, New Jersey and Southern Connecticut, so houses that appeal to this market can be hundreds of miles apart. The final determination of the best comparable sales is solely up to the appraiser.

Ask Henry

Dear Henry,

I am a certified residential appraiser, and I, along with a couple other appraisal firms, would like to start up an appraisal management company. Being appraisers, and never having gone down this road before, we are not sure where to begin. Where do we find the information that is necessary to create an appraisal management company in order to meet all of the necessary requirements, and to be legitimate? Do you have any resources pertaining to this?

Thank you for any help you may be able to offer.

Regards,

Keith VandenAkker

keithva@charter.net

Dear Keith,

Each state has its own requirements for AMCs. You should start by asking someone on the staff of your state's appraisal commission how to proceed. I think you should also hire a lawyer to advise you.

Ask Henry

Dear Henry,

On an FHA purchase appraisal, after the inspection, in the normal course of conversation with the home owner I was asked if there were any problems with their home. I stated that there were three problems that needed to be addressed, without going into the details of the problems. I told the homeowner that these issues needed to be addressed before the home could transfer title. By the time I got back to the office, the mortgage broker was on the phone telling me these issues did not exist. He called the appraisal management company and tried to cancel the appraisal. The appraisal management company then called me and told me that the appraisal was being reassigned because I disclosed information to an unintended user, and that I was in violation of USPAP rules. Did I really violate USPAP rules by answering a simple question honestly?

Kristina Fittipaldi

Spoiledbrat10117@aol.com

Dear Kristina,

The USPAP requires that every appraisal report contain a statement as to who the intended User(s) are. If you stated that the intended user was the Lender/Client, then the only people you can discuss the appraisal with is the Lender/Client. If you stated that an intended user was the property owner or someone else, you could discuss the report with them. Generally, it is a good policy not to discuss your appraisal with property owners, as all it can do is get you into trouble. When asked a direct question about the appraisal or your inspection, I recommend that you politely say you are not permitted to discuss the appraisal with anyone other than the intended user and that the owner is free to contact them for information.

Ask Henry

Dear Henry,

Can an appraisal done as a USDA appraisal be switched to an FHA appraisal, or would the property have to be re-inspected?

Kind regards,

Jeff Bridwell

jeff.bridwell@inhouse-solutions.com

Dear Jeff,

Whenever the client changes, a new appraisal is required by the USPAP. This means that there must be a new scope of work dialogue with the new client. There are no USPAP requirements about inspections; therefore, if the effective date and inspection date are the same, I think you will just need to rewrite the appraisal being sure you have covered everything required in the new scope of work.

Ask Henry

Dear H2,

Recently, I received a request from a mortgage company to change an address on an appraisal that had been ordered by an AMC for a major bank. A few days later, I received another message, with a copy of a memo from the Lender, saying that they were sending the appraisal over to the mortgage company but "assumed no liability for the content." The Lender had received the appraisal over one year ago. I spoke with a representative at the AMC and confirmed that since the issue had changed from a request for an address correction to a transfer of the appraisal to a new lender, the new lender would need to order a new appraisal. When I informed the contact person at the mortgage company that she would need to order a new appraisal, she said "no other appraiser has ever told them that since the HVCC took effect." It was my understanding from a CE class a few years ago that it is misleading to change the name of the Lender and that a new appraisal must be done. Please advise!

Kathy Vogt

vogtb001@hawaii.rr.com

Dear Kathy,

The USPAP has a lot of rules about changing the name of the lender/client on a report. The essence is that the lender and the appraiser together develop a scope of work for the appraisal. Therefore if all you do is change the name of the lender, you have not complied with the Scope of Work development process with the new lender. Changing a delivery address for the same Lender would probably be okay. Transferring an appraisal to a new lender would clearly violate the USPAP requirements.