News

News

04/25/11

FHFA Before the U.S. House of Representatives Subcommittee on Capital Markets, Insurance, and Government-Sponsored Enterprises

Chairman Garrett, Ranking Member Waters and members of the Subcommittee, thank you for inviting me to speak this morning on the Federal Housing Finance Agency’s (FHFA) role as conservator of Fannie Mae and Freddie Mac (the Enterprises) and on proposals regarding the future of the Enterprises...

It is critically important that Congress and the Administration begin the work to define the longterm structure of housing finance. While substantive disagreements about the features of that structure exist, there is near universal agreement that we should not follow the old paradigm. We appreciate the efforts that the Sub-committee has taken to start this process... Read More...

Interview with Henry S. Harrison

03/15/11

The UAD is Coming! THE UAD IS COMING!

Interview with Henry S. Harrison

by his wife Ruth Lambert, Editor, Real Estate Valuation Magazine Online

Henry - can you explain to our readers what you are working on now?

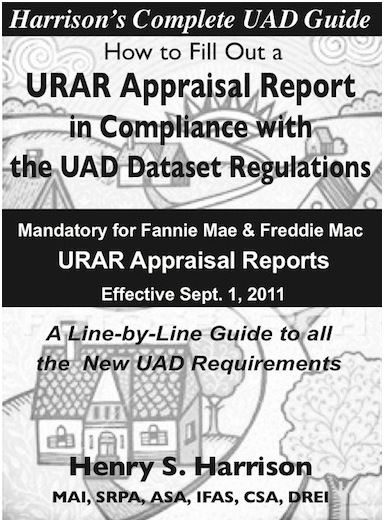

Henry (H2): For the past few weeks, we have been very involved with the birth of our 5th grandchild, Sterling Harrison Muchnick, born February 23rd. Now I am back at work on my latest book "Harrison's Complete UAD Guide for the URAR."

What is the UAD? How will it affect appraisers?

H2: According to Fannie Mae and Freddie Mac (aka the GSEs), they "have developed the Uniform Mortgage Data Program (UMDP) to enhance the accuracy and quality of loan data delivered to each GSE. The Uniform Appraisal Dataset (UAD) is a key component which defines all fields required for an appraisal submission on one of four standard appraisal forms, and standardizes definitions and responses for a key subset of fields." What this means is that soon Fannie and Freddie will no longer accept appraisals on paper — only electronic transmissions from the lenders. In addition, they will require that all these appraisals be formatted exactly as delineated in the UAD, or their computers will reject them.

Read More...

Interview with Henry S. Harrison

by his wife Ruth Lambert, Editor, Real Estate Valuation Magazine Online

Henry - can you explain to our readers what you are working on now?

Henry (H2): For the past few weeks, we have been very involved with the birth of our 5th grandchild, Sterling Harrison Muchnick, born February 23rd. Now I am back at work on my latest book "Harrison's Complete UAD Guide for the URAR."

What is the UAD? How will it affect appraisers?

H2: According to Fannie Mae and Freddie Mac (aka the GSEs), they "have developed the Uniform Mortgage Data Program (UMDP) to enhance the accuracy and quality of loan data delivered to each GSE. The Uniform Appraisal Dataset (UAD) is a key component which defines all fields required for an appraisal submission on one of four standard appraisal forms, and standardizes definitions and responses for a key subset of fields." What this means is that soon Fannie and Freddie will no longer accept appraisals on paper — only electronic transmissions from the lenders. In addition, they will require that all these appraisals be formatted exactly as delineated in the UAD, or their computers will reject them.

Read More...

News

02/16/11

Statement from FHFA Acting Director Edward J. DeMarco

on the Administration’s Housing Finance Reform Report

“I am pleased that the Administration today put forward a framework to strengthen the nation’s housing finance system, restore the critical role of private capital, and identify options for the long-term structure of housing finance.

The conservatorships of Fannie Mae and Freddie Mac, with funding from the Treasury Department, were put in place to provide near-term stability to the mortgage market and to give policymakers an opportunity to evaluate the role of the government in housing finance. Currently, the Federal government is providing support for over 90 percent of new mortgage originations, a level of involvement that should not be maintained.

As debate over the future of the housing finance system progresses, FHFA will continue to meet the goals of the conservatorships, which include retaining value in the Enterprises’ business operations and maintaining their support for the housing market. Since the conservatorships were established, the Enterprises have strengthened their underwriting standards and enhanced their loss mitigation tools. The work of FHFA is consistent with the Administration’s focus on stronger underwriting and pricing, and the re-introduction of private capital.

Certain elements of the Administration’s framework involve preparing the Enterprises, the Federal Home Loan Banks, and other market participants for the transition to a future structure for housing finance. We will consider and discuss with the Administration the details of the framework announced today, consistent with our responsibilities as conservator and regulator. FHFA also will continue to take other steps to strengthen the mortgage market of the future. For example, we have already initiated programs to standardize mortgage data submissions and consider servicing compensation reforms.

FHFA looks forward to working with the Administration and Congress to restore the functioning of private markets and preserve the stability and liquidity of the secondary mortgage market.”

on the Administration’s Housing Finance Reform Report

“I am pleased that the Administration today put forward a framework to strengthen the nation’s housing finance system, restore the critical role of private capital, and identify options for the long-term structure of housing finance.

The conservatorships of Fannie Mae and Freddie Mac, with funding from the Treasury Department, were put in place to provide near-term stability to the mortgage market and to give policymakers an opportunity to evaluate the role of the government in housing finance. Currently, the Federal government is providing support for over 90 percent of new mortgage originations, a level of involvement that should not be maintained.

As debate over the future of the housing finance system progresses, FHFA will continue to meet the goals of the conservatorships, which include retaining value in the Enterprises’ business operations and maintaining their support for the housing market. Since the conservatorships were established, the Enterprises have strengthened their underwriting standards and enhanced their loss mitigation tools. The work of FHFA is consistent with the Administration’s focus on stronger underwriting and pricing, and the re-introduction of private capital.

Certain elements of the Administration’s framework involve preparing the Enterprises, the Federal Home Loan Banks, and other market participants for the transition to a future structure for housing finance. We will consider and discuss with the Administration the details of the framework announced today, consistent with our responsibilities as conservator and regulator. FHFA also will continue to take other steps to strengthen the mortgage market of the future. For example, we have already initiated programs to standardize mortgage data submissions and consider servicing compensation reforms.

FHFA looks forward to working with the Administration and Congress to restore the functioning of private markets and preserve the stability and liquidity of the secondary mortgage market.”

###

The Federal Housing Finance Agency regulates Fannie Mae, Freddie Mac and the 12 Federal Home Loan Banks. These government-sponsored enterprises provide more than $5.9 trillion in funding for the U.S. mortgage markets and financial institutions.

News

02/03/11

The Chinese New Year - Year of the Golden Rabbit

This should be a placid year, very much welcomed and needed after the ferocious year of the Tiger. We should go off to some quiet spot to lick our wounds and get some rest after all the battles of the previous year. Good taste and refinement will shine on everything and people will acknowledge that persuasion is better than force. Diplomacy, international relations and politics will be given a front seat again. We will act with discretion and make reasonable concessions without too much difficulty. One warning: do not become too self-indulgent. The influence of the Rabbit tends to spoil those who like comfort and thus impairs their effectiveness and sense of duty when action is needed.

This should be a placid year, very much welcomed and needed after the ferocious year of the Tiger. We should go off to some quiet spot to lick our wounds and get some rest after all the battles of the previous year. Good taste and refinement will shine on everything and people will acknowledge that persuasion is better than force. Diplomacy, international relations and politics will be given a front seat again. We will act with discretion and make reasonable concessions without too much difficulty. One warning: do not become too self-indulgent. The influence of the Rabbit tends to spoil those who like comfort and thus impairs their effectiveness and sense of duty when action is needed.

- The Handbook of Chinese Horoscopes by Theodora Lau, Harper & Row Perennial, 1979.

- The Handbook of Chinese Horoscopes by Theodora Lau, Harper & Row Perennial, 1979.

News

01/27/11

SAVE THE DATE: Friday, April 8, 2011 • 9:00am – 12:00pm

Grand Hyatt San Antonio 600 East Market Street San Antonio, TX 78205

Meeting Agenda:

The Appraisal Standards Board (ASB) will meet in San Antonio in April to make its final consideration of revisions for the 2012-13 edition of USPAP.

Based on the feedback from the Fourth Exposure Draft, the Board will expose its Fifth (and final) Exposure Draft for proposed changes for the 2012-13 edition of USPAP in mid-February, 2011.

Written comments in response to the Fifth Exposure Draft will be accepted through April 1st, 2011. Oral comments will also be accepted at the April 8th public meeting. The Board plans to adopt revisions for the 2012-13 edition of USPAP at the April 8, 2011 public meeting.

Please note that this meeting will be followed by a meeting of the State Regulator Advisory Group at 1:00 p.m., and these two meetings are at the Grand Hyatt Hotel; the AARO (Assoc. of Appraiser Regulatory Officials) Conference is being held at the Hotel Contessa at 306 West Market Street in San Antonio.

![]()

Your online registration will assure proper seating at the meeting.

Standards Administrator: Carrie Cadle

202-624-3058 | carrie@appraisalfoundation.org

Events/Meeting Registration