Ask Henry

Dear Mr. Harrison,

I'm having problems defining the address for many properties I appraise. Here in New Jersey we have properties (typically within Townships) that utilize both (1.) "census-designated" areas (or districts) within the township or (2.) names of neighboring towns for use in their "Mailing Address".

For example:

125 Main Street, MORGANVILLE, NJ is in Marlboro Township

125 Main Street, BELLE MEAD, NJ could be in either Hillsborough or Montgomery Township

125 Main Street, PRINCETON, NJ could actually be in South Brunswick Township (e.g., a different town and county)

I have always written my reports to identify the actual "CITY", "TOWNSHIP" or "BORO" (as per TAX RECORDS) within the CITY FIELD on the appraisal report.

I have always identified within the ADDRESS FIELD on the appraisal report the "mailing address", which would read as noted above.

Thus:

ADDRESS: 125 Main Street (Princeton) CITY: South Brunswick Township

I always include language (in the notes section) as to where I obtained this data, an explanation about census-designated areas or districts within townships, or comments (as in the example above) that the mailing address may utilize the name of a neighboring town.

If an appraiser were to not identify the actual Township, I feel this could be misleading. Especially in the examples used above with both Belle Mead and Princeton: if an appraiser were to only identify "Belle Mead", what actual TOWNSHIP is it in -- Hillsborough or Montgomery?

If an appraiser were to only identify "Princeton", the reader might actually think the property is in Princeton (Mercer County) and not South Brunswick (Middlesex County). Both answers are therefore misleading and incomplete.

Now, AMCs inform me their lender clients want "Princeton" ONLY in the CITY Field. I cannot agree with that. So here comes the question: What is the proper way to do this, and handle my concerns and dilemma with the AMCs? Thanks in advance for your help.

Randy L. Cohen, SCRREA

DK REAL ESTATE APPRAISAL INC.

dkappraisal@yahoo.com

Dear Randy,

I'm sure it is frustrating to be told to report something that makes no sense, given the complexity of place names in your area. You will no longer have this problem starting September 1st, 2011 when URAR appraisal reports will have to comply with the new UAD requirements. These requirements will become mandatory on that date for all appraisals to be sold to Fannie Mae and Freddie Mac. They will be computer checked and when the computer rejects the appraisal, it will be returned to the lender for corrections. How the corrections will be made and by whom will vary.

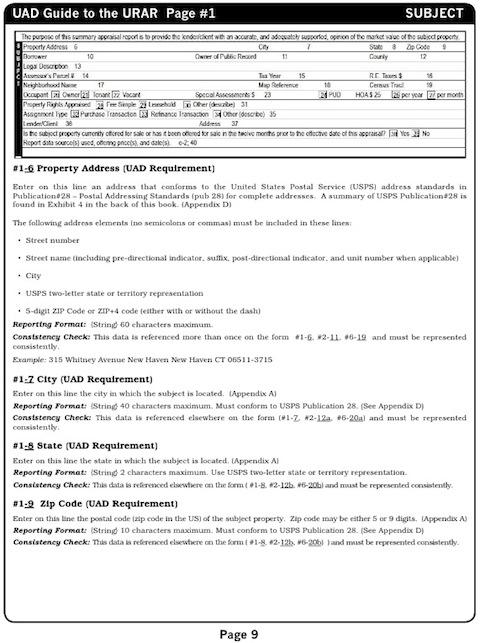

Below is an excerpt from my new UAD book, regarding the UAD requirements on how to report Property Address. It is highly codified, as you will see, and does not permit any deviations from their format. You may have to add your notes about the actual property address versus the mailing address in your addenda, to avoid the problems you outline above. The UAD guide contains a condensation of USPS Regulation 28 which is all you need for most locations. However, in locations like yours, I suggest you contact the postmaster in the area where you are working and get their opinion of the correct address requirements for the location of the subject property.

HSH

askhenryharrison@revmag.com

For more information about my new book, to be published April 30th, and to pre-order a copy now (and get a $5 pre-publication discount), use Discount Code $5PPUAD and click this link: HARRISON's COMPLETE UAD BOOK (PRE-ORDER)